According to Gaap Regarding Leasing Discloures Which of the Following

Occasionally FASB will additionally. Target Corporation prepares its financial statements according to US.

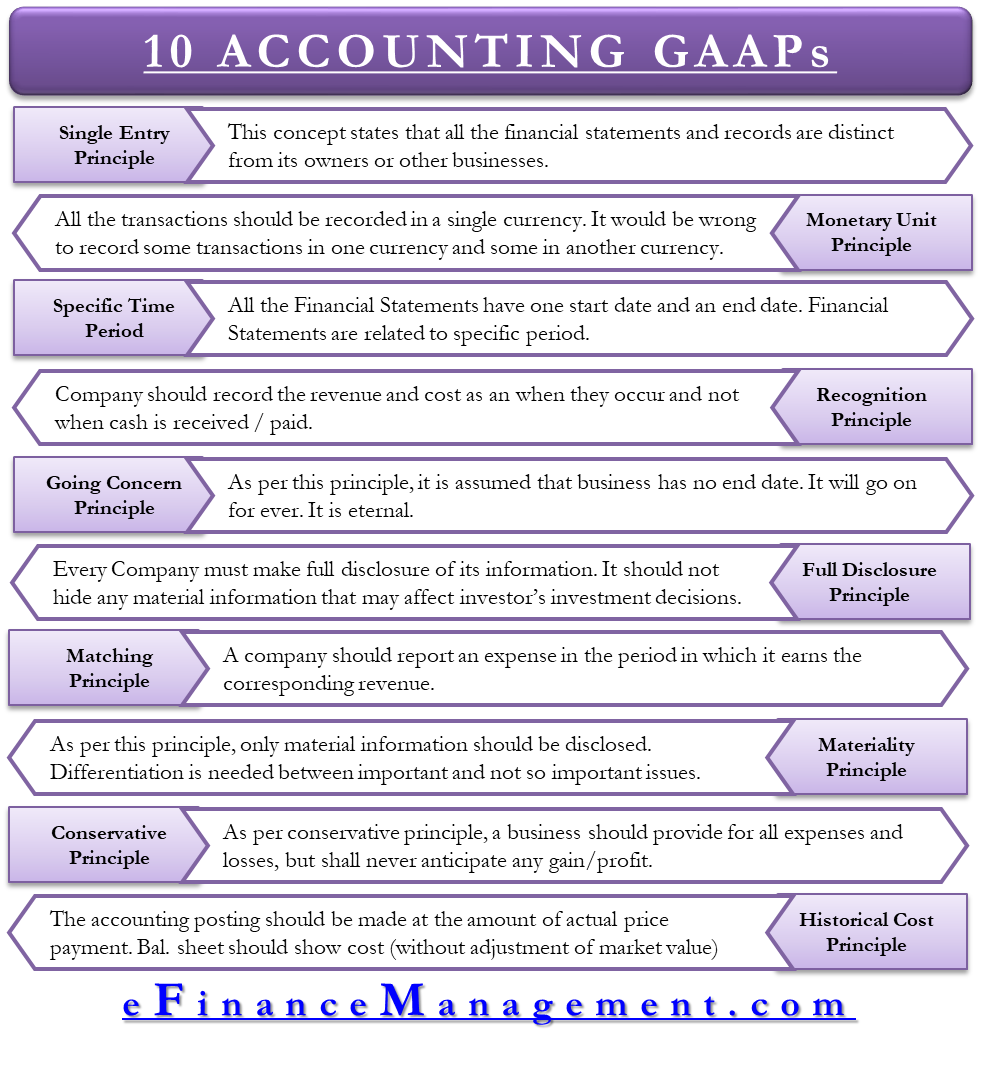

What Are All 10 Gaap Principles Origin Brief Description Of Each Efm

In periods prior to adoption of the leasing standard entities are required to make disclosures under the SECs Staff Accounting Bulletin No.

. Accounting for finance leases under ASC Topic 842 and for capital leases under the legacy lease standard are similar because they both require a lessee to record an asset and liability for the present value of the lease payments. Definition of Generally Accepted Accounting Principles. New NFP Financial Reporting Standards.

If the company owns the equipment or has an option to purchase the equipment at a bargain price. In 2016 the FASB issued ASU 2016-01 Financial InstrumentsOverall Subtopic 825-10. On February 25 2016 the FASB issued Accounting Standards Update No.

75 of the fair value of the asset. All four of the criteria specified by GAAP regarding accounting for leases. The FASB lease classification test is as follows.

FASB Special ReportThe Framework of Financial Accounting Concepts and Standards. The lease would have been classified as a sales-type lease or a direct financing lease in accordance with the classification criteria in. Began the first quarter with 1000 units of inventory costing 25 per unit.

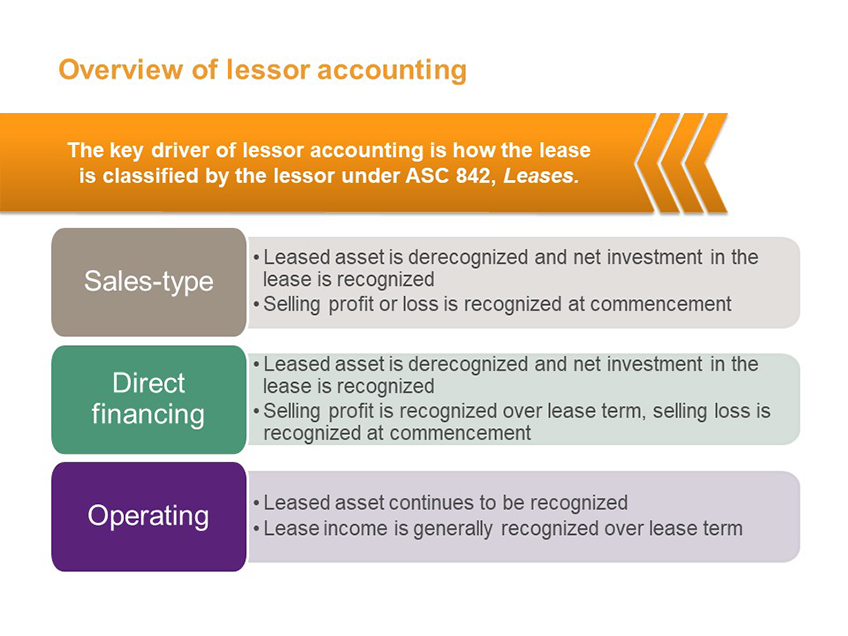

While not as dramatic changes for lessor accounting include those to align with certain changes in the lessee model and the new revenue recognition standard. Distinguishing Liabilities from Equity. A lessee effectively obtains control of the underlying asset when the lease meets any of the following criteria at lease commencement.

Leases Topic 842 The lease standard is. We review their content and use your feedback to keep the quality high. Two of the GAAP lease accounting criteria for capital leases concern the disposition of the equipment at the end of the contract.

This post explores the tax impacts of the new lease accounting standard. A lessee shall disclose information about all of the following. 90 of the fair value of the asset.

The adoption of Accounting Standards Codification ASC 842 Leases makes accounting much more complex for traditional operating leases. Not surprisingly the disclosure requirements are quite extensive. Unlike finance leases however accounting for operating leases is substantially different under the new standard.

A general description of leases The basis and terms and conditions on which variable lease payments are determined. 90 of the cost of the asset. Qualitative Disclosures Nature of leases as well as any subleases including.

This problem has been solved. Additionally the new leases standard has specific requirements as to how leasing activity is to be presented in the basic financial statements. The below summary discusses each of the Financial Accounting Standards Board Accounting Standards Updates ASUsissued in 2021 as well as the ASUs effective for December 31 2021 financial statements.

Consistent with current Generally Accepted Accounting Principles GAAP the recognition measurement and presentation of expenses and cash flows arising from a lease by a lessee primarily will depend on its classification as a finance or operating lease. FASBs Accounting Standards Update ASU 2017-03 added guidance ASC 250-10-S99-6. The FASBs lease accounting standard change ASC 842 presents dramatic changes to the balance sheets of lessees.

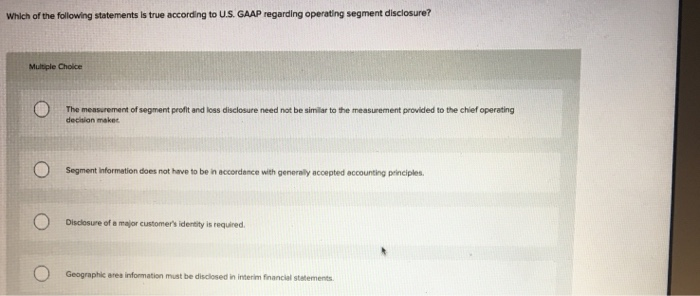

Accounting for the Tax Cuts and Jobs Act. The FASB has been. The following statements are true according to US GAAP regarding operating segment disclosure.

Standard Poors Ratings Services Comments On The FASBIASB Discussion Paper Regarding Lease Accounting Editors Note. What are generally accepted accounting principles GAAP. GAAP FER standards and the completeness of disclosure requirements.

Based on our experience the checklist includes the most important requirements regarding the application and disclosure of Swiss GAAP FER for individual and consolidated financial statements. The following is the text of a response sent by Standard Poors Ratings Services Chief QualityOfficer and Chief Accountant Neri Bukspan to the Financial Accounting Standards and International Accounting. GAAP for leases ASC 840 arent terribly insightful but this is about to change under the new lease accounting standard ASC 842.

SAB 74 requires that when a recently. Experts are tested by Chegg as specialists in their subject area. Targets financial statements and disclosure notes for the year ended February 3 2018 are available here.

By Howard B. Lease Presentation Disclosure Requirements. For the lessee to account for a lease as a capital lease the lease must meet.

Generally accepted accounting principles commonly referred to as GAAP or US GAAP are the common accounting rules that must be followed when a US. 75 of the cost of the asset. This article contains practical guidance and support as to the appropriate disclosure of the expected effects of significant future accounting changes from new GAAP standards that have been enacted but are not yet effective or adopted.

74 codified in SAB Topic 11M Disclosure Of The Impact That Recently Issued Accounting Standards Will Have On The Financial Statements Of The Registrant When Adopted In A Future Period SAB 74. 2016-02 Leases Topic 842 to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing transactions. The amendments in this Update require lessors to classify and account for a lease with variable lease payments that do not depend on a reference index or a rate as an operating lease if both of the following criteria are met.

However unlike current GAAPwhich requires only capital leases to be recognized on the balance sheet the new ASU. Generally FASB sets effective dates by segregating public business entities PBE from all other entities. Other Accounting for Leases Issues.

During the first quarter 3000 units were purchased at a cost of 40 per unit and sales of 3400 units at 65 per units were made. Company prepares financial statements that will be distributed to people outside of the company. During the second quarter the company expects to replace the units of beginning inventory sold at a cost of 45 per.

In addition the checklist contains industry-specific Swiss GAAP. Recognition and Measurement of Financial Assets and Financial Liabilities ASU 2016-01 to address the recognition measurement presentation and disclosure of. A lessee shall classify a lease as a finance lease if the lessee effectively obtains control of the underlying asset as a result of the lease.

Stepping It Up From ASC 840 To ASC 842 The disclosure requirements under current US. FASB Response to COVID-19. To help you stay on track weve compiled a short list of new 2022 GAAP accounting standards that are effective now so you can make sure youre set up for a smooth GAAP-filled year.

Wiley Regulatory Reporting Wiley Gaap 2021 Interpretation And Application Of Generally Accepted Accounting Princ Accounting Principles Accounting Principles

Lease Accounting An Overview Of Asc 842 Gaap Dynamics

Solved Which Of The Following Statements Is True According Chegg Com

No comments for "According to Gaap Regarding Leasing Discloures Which of the Following"

Post a Comment